Guidance note: Making Tax Digital October 2020

It is hard to believe that Making Tax Digital (MTD) for VAT came into force nearly 18 months ago! As the NFU’s sole recommended farm software supplier, Landmark successfully worked in partnership with them to deliver software for MTD Phase 1 in 2019, facilitating digital submission of VAT returns for over 7,000 companies using our KEYPrime range of accounting software.

We’ve put together the advice below, to ensure that you can continue to submit your VAT returns through the KEYPrime range of accounting software with ease.

Make sure you keep up with your KEYPrime software updates

In line with HMRC’s continued Making Tax Digital (MTD) development, Landmark have had to implement changes accordingly.

These changes are all behind the scenes in KEYPrime and will not affect the way you process and submit your returns. However, they are critical for the continued service and security of your VAT submission. Without them your submission will be rejected by HMRC.

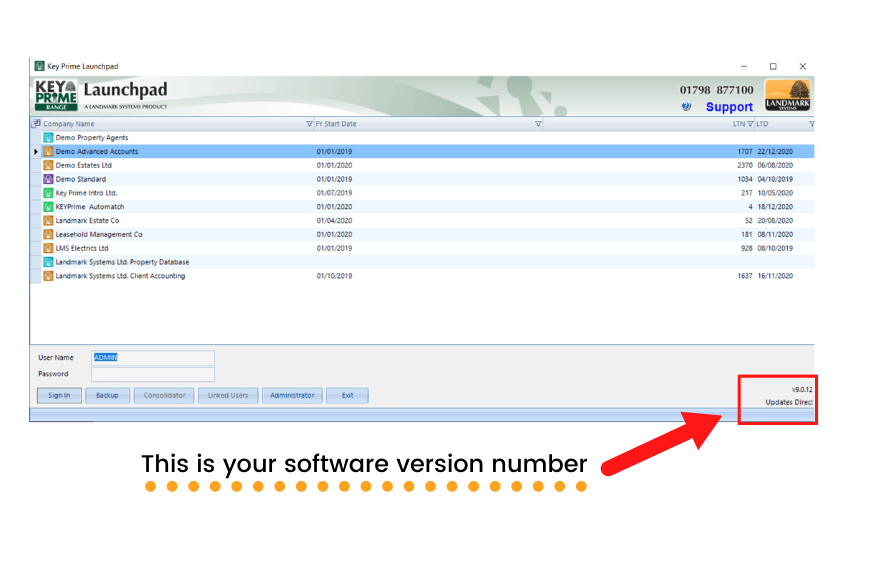

It is therefore vital that you ensure you keep your KEYPrime accounts range software up to date to get these changes. Please make sure that you are running on version 9.0.12 or later. You can check your version of KEYPrime on the bottom right of the Launchpad.

It is also advised that you make sure that your operating system is up to date to take advantage of the latest security settings and standards.

Software authorisation expiry

Software authorisation expiry

The authorisation tokens you activated allowing your accounts software to submit VAT returns to the new HMRC VAT portal in 2019 will need to be renewed after 18 months. So, it is likely that when you come to submit your next VAT return through your software, you will be informed that the authorisation was not successful. This is nothing to worry about…

Our KEYPrime Accounts software users will be prompted to re-authorise their token applications and re-directed to the HMRC Government Gateway. Here the process of re-activating your authorisation token is quite simple. Once complete, you will be able to go back to your accounts software and submit your return as usual.

Making Tax Digital Phase 2

Following the government’s announcement in July this year, KEYPrime will enable all remaining VAT registered entities (ie. those below the £85k threshold) to file returns digitally by the April 2022 period deadline and ensure our customers are ready for the next phase of MTD for income tax.

If you have any questions about the above, please do not hesitate to get in touch with the support team who will be happy to help.